The smart Trick of Three Things To Avoid When You File Bankruptcy That No One is Discussing

If Anytime the financial debt settlement business doesn’t adhere to its contract, you ought to reach out to the attorney.

Consolidation financial loans have fixed conditions and glued desire fees, to help you take Charge of your credit card debt, know particularly when you will end up credit card debt-totally free, and pay off your personal debt faster. How can credit card debt consolidation function?

Closing expenditures can include as many as many thousand pounds, masking charges which include appraisal fees, title insurance plan and legal professional expenses. Finances for these expenses and critique the closing disclosure provided by your lender to grasp all charges concerned.

Chapter 11 is usually often called “reorganization bankruptcy” as it presents firms a chance to function when they restructure the debts and assets to pay again creditors.

Personal debt consolidation can assist increase credit history if it can help somebody make payments on time while also decreasing the amount of money owed on various accounts.

Chapter seven handles unsecured debts for example charge cards or personalized financial loans, in addition to health-related bills, utility costs and civil courtroom judgments that aren’t according to fraud. Even so, it is not going to remove boy or girl assistance, alimony, student loans and secured useful reference debts.

“You should halt using your bank cards as soon as you think that you will file for bankruptcy,” Tayne advises. “For a single, you don’t know needless to say that your debts will likely be discharged.

Earn more cash. Besides cutting costs, you can also make an effort to raise the amount of money that you simply make monthly.[8] X Study supply

A bankruptcy trustee can undo a transfer of real or own house that Beforehand belonged to you, When read the transfer lacked enough consideration or no thought was supplied. A trustee has the statutory ability to avoid a fraudulent transfer that was designed within two many years beneath the U.

Then, simply call each and every charge card business and establishment have a peek here you owe revenue to and ask about personal debt repayment options. Several lenders will forgive fees and operate with you to figure out a repayment strategy. Thanks! We're glad this was handy.

The technical storage or obtain is necessary for the legitimate objective of storing preferences that aren't requested with the subscriber or person.

Getting a single automated continue to be violation can cost Many pounds when a legal professional sues on behalf of the debtor for any.”Movement for Damages for Violation of Keep.”

Easily regulate regulatory threats Continued and stay compliant with the most recent regulatory norms on asset top quality classifications and provisions pertaining to bank loan allowance calculations.

Occupation prospective clients – In some fields, bankruptcy can disqualify you from Employment in which you will be deemed a protection Related Site hazard.

Rider Strong Then & Now!

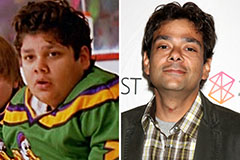

Rider Strong Then & Now! Shaun Weiss Then & Now!

Shaun Weiss Then & Now! Jason J. Richter Then & Now!

Jason J. Richter Then & Now! Michael Bower Then & Now!

Michael Bower Then & Now! Rossy de Palma Then & Now!

Rossy de Palma Then & Now!